|

The Spot Electricity Market consists of:

- Day-Ahead Market - MGP (energy market);

- Intra-Day Market - MI (energy market);

- Daily Products Market – MPEG (energy market);

- Ancillary Services Market- MSD.

The Day-Ahead Market (MGP) hosts most of the electricity sale and purchase transactions.

- In the MGP, hourly energy blocks are traded for the next day.

- Participants submit bids/asks where they specify the quantity and the minimum/maximum price at which they are willing to sell/purchase.

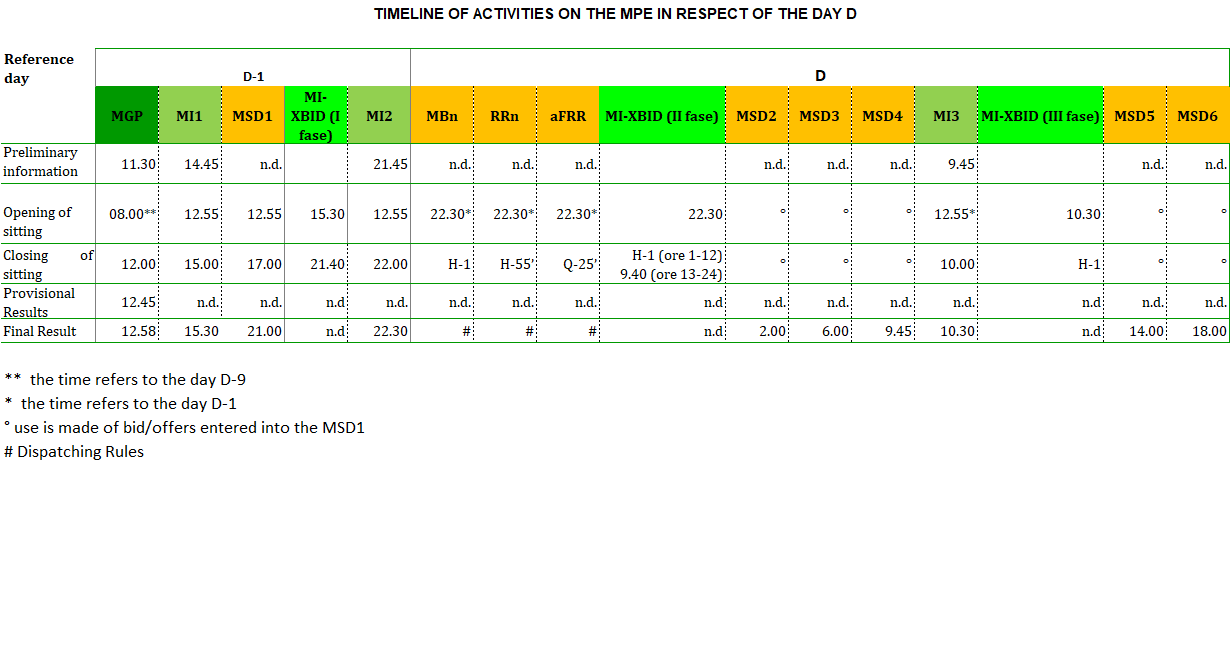

- The MGP sitting opens at 8 a.m. of the ninth day before the day of delivery and closes at 12 p.m. of the day before the day of delivery. The results of the MGP are made known within 12.58 p.m. of the day before the day of delivery.

- Bids/asks are accepted after the closure of the market sitting based on the economic merit-order criterion and taking into account transmission capacity limits between zones. Therefore, the MGP is an auction market and not a continuous-trading market.

- All the supply offers and the demand bids pertaining both to pumping units and consuming units belonging to foreign virtual zones that are accepted in the MGP are valued at the marginal clearing price of the zone to which they belong. This price is determined, for each hour, by the intersection of the demand and supply curves and is differentiated from zone to zone when transmission capacity limits are saturated.

- The accepted demand bids pertaining to consuming units belonging to Italian geographical zones are valued at the “Prezzo Unico Nazionale” (PUN – national single price); this price is equal to the average of the prices of geographical zones, weighted for the quantities purchased in these zones.

- GME acts as a central counterparty.

The Intra-Day Market (MI) allows Market Participants to modify the schedules defined in the MGP by submitting additional supply offers or demand bids. Trading on the MI takes place through the carrying out of three MI-A auction sessions and one MI-XBID continuous trading session.

- In the MI-A auction sessions, at the same time as the negotiation of the purchase and sale offers, the intraday interconnection capacity is allocated between all the areas of the Italian market and the other geographic areas interconnected to the same involved in the Market Coupling

- The sitting of the MI-A1 takes place after the closing of the MGP. It opens at 12.55 p.m. of the day before the day of delivery and closes at 3 p.m. of the same day. The results of the MI-A1 are made known within 3.30 p.m. of the day before the day of delivery.

- The sitting of the MI-A2 opens at 12.55 p.m. of the day before the day of delivery and closes at 10.00 p.m. of the same day. The results of the MI-A2 are made known within 10.30 p.m. of the day before the day of delivery.

- The sitting of the MI-A3 opens at 12.55 p.m. of the day before the day of delivery and closes at 10.00 a.m. of the day of delivery. The results of the MI-A3 are made known within 10.30 a.m. of the day of delivery.

- Supply offers and demand bids are selected under the same criterion as the one described for the MGP.

- Unlike in the MGP, accepted demand bids are valued at the zonal price.

- MI-XBID continuous session is divided into three phases, within which, within the context of the negotiation of purchase and sale offers, the intraday interconnection capacity between all the areas of the Italian market and the other geographical areas is allocated to the same interconnected active ones in the XBID.

- The MI-XBID phase I session opens at 3.30 p.m. on day D-1 and closes at 9.40 p.m. on day D-1.

- The MI-XBID phase II session opens at 10.30 p.m. on day D-1 and closes:

- for the relevant periods corresponding to the first twelve hours of day D, one hour before the start of each relevant period (h-1);

- for the relevant periods corresponding to the second twelve hours of day D, at 09.40 a.m. of day D.

- The MI-XBID phase III session opens from 10.30 a.m. on day D and closes one hour before the start of each relevant period (h-1).

- Bids and offers can be submitted per unit and per portfolio.

- For each phase of continuous trading of the MI-XBID, GME organizes a trading book by geographical and/or virtual areas.

- the MI-A auction sessions and the trading phases of the MI-XBID session take place sequentially and without overlaps, in the following order: a) MI-A1; b) MI-XBID phase I; c) MI-A2; d) MI-XBID phase II; e) MI-A3; f) MI-XBID phase III.

- GME acts as a central counterparty.

The Daily Products Market (MPEG) is the venue for the trading of daily products with the obligation of energy delivery.

- The MPEG automatically admit all Participants in the electricity market.

- Trading in the MPEG takes place in continuous mode.

- The MPEG allows trading daily products with:

- “unit price differential”, for which the price indicated in the preparation of bids/asks and so the price determined on completion of the trading phase is the differential expression compared to the PUN, to which Participants are willing to trade such products;

- “full unit price”, for which the price indicated in the preparation of bids/asks and so the price determined as a result of the trading phase is the expression of the unit value of electricity exchange subject of the traded contracts.

- In the MPEG for both types of products (“unit price differential” and “full unit price”) are negotiable the following delivery profiles:

- Baseload, listed for all calendar days, whose underlying is the electricity to be delivered in all the applicable periods belonging to the day being traded;

- Peak Load, listed for the days from Monday to Friday, whose underlying is the electricity to be delivered in the applicable periods from the ninth to the twentieth day belonging to the date subject of trading.

- Participants of the Electricity Market that are also Participants of the PCE, enabled to register translations on the electricity accounts available, can buy and sell daily products in the MPEG.

- The net electricity delivery position from the daily products trading exchanged in the MPEG is recorded in correspondent transactions in the PCE according to the modes set forth in the Electricity Market Rules.

- GME acts as a general counterparty.

- The sessions of the MPEG take place on weekdays, as specified below:

- from 8.00 to 17.00 of D-2. If D-2 is a public holiday, the session will take place from 8.00 to 5.00 p.m. on the working day immediately before;

- from 8.00 to 9.00 of D-1, only if such day is not a public holiday, It follows that if the day D is preceded by a public holiday, the trading session for the product to be delivered in D will take place only from 8.00 to 5.00 p.m. on the first working day prior to the day D*.

* On Friday they will be traded:

- From 8 to 9 the products to be delivered on Saturday

- From 8 to 17 the products to be delivered on Sundays and the products to be delivered on Monday and Tuesday (the latter product will also be traded from 8.00 to 9.00 of the session which takes place on Mondays).

The daily products currently traded in the MPEG are the products with the "unit price differential", with Baseload and Peak Load delivery profiles.

The Ancillary Services Market (MSD) is the venue where Terna S.p.A. procures the resources that it requires for managing and monitoring the system relief of intra-zonal congestions, creation of energy reserve, real-time balancing. In the MSD, Terna acts as a central counterparty and accepted offers are remunerated at the price offered (pay-as-bid).

The MSD consists of a scheduling substage (ex-ante MSD) and Balancing Market (MB). The ex-ante MSD and MB take place in multiple sessions, as provided in the dispatching rules.

The ex-ante MSD consists of six scheduling substages: MSD1, MSD2, MSD3, MSD4, MSD5 and MSD6. The sitting for bid/ask submission into the ex-ante MSD is a single one. It opens at 12.55 p.m. of the day before the day of delivery and closes at 5.00 p.m. of the same day. The results of the MSD1 are made known within 9.45 p.m. of the day before the day of delivery. GME notifies Market Participants of the individual results of the MSD2 session (as specified in the dispatching rules) concerning the bids/asks accepted by Terna within 2.15 a.m. of the day of delivery.

GME notifies Market Participants of the individual results of the MSD3 session (as specified in the dispatching rules) concerning the bids/asks accepted by Terna within 6.15 a.m. of the day of delivery.

GME notifies Market Participants of the individual results of the MSD4 session (as specified in the dispatching rules) concerning the bids/asks accepted by Terna within 10.15 a.m. of the day of delivery.

GME notifies Market Participants of the individual results of the MSD5 session, (as specified in the dispatching rules), concerning the bids/asks accepted by Terna within 2.15 p.m. of the day of delivery. GME notifies Market Participants of the individual results of the MSD6 session, (as specified in the dispatching rules), concerning the bids/asks accepted by Terna within 6.15 p.m. of the day of delivery.

In the ex-ante MSD, Terna accepts energy demand bids and supply offers in order to relieve residual congestions and to create reserve margins.

The Balancing Market consists of the continuous submission of offers, with hourly readings for the 24 hours of flow day D. Opening of the session for the submission of offers for the Balancing Market is at 10.30 pm on the day before flow day D. Market Participants may submit offers up to 60' before the start of the hour H to which these offers refer.

For offers referring only to the energy exchange platform for balancing from the Replacement Reserve (RR Platform), the limit for the submission of offers by Market Participants is H-55'.

Only for Automatic Frequency Restoration Reserve (aFRR) offers specific to the Energy Exchange Platform, for Balancing from Automatic Frequency Restoration Reserve, the limit for the offer submission by participants is 25 minutes before the start of the quarter hour (Q) to which these offers refer (Q-25').

|